You need finance for your company growth.

You've come to the right place.

Because we consider your future to be our business.

Keep your options open

There are sometimes multiple solutions to any given problem but some are clearly better than others…with multiple benefits too. This is never truer than with finance.

Here are 5 clear benefits from the get-go.

FlexiPay options

You can pay however it suits; monthly, quarterly, biannually or annually. Direct Debit, Standing Order or Invoice. From 3 months to 10 years plus*. Whatever suits you.

Upgrade easy

When your phone gets old you upgrade it, right? With finance you can have the option to do that with all your purchases. Future proof.

Pay as you Go

No installments to pay until the kit is up and running so the sooner you get it the quicker the returns. So much easier to justify.

Cash flow valve

Spreading the cost through finance takes the pressure off your cash flow as you can keep capital in your business and let’s face it…cash is always king.

Pain relief

By encompassing installation, maintenance and service agreements we’ll take the pain out of growth leaving you to keep your eye on the bigger picture.

Contents

Why Clear?

Partner pairing

Customer stories

Equipment finance

HP & Leasing

Commercial loans

Inc. VAT or Corporation Tax funding

Cash flow facilities

Inc. Trade finance & invoice discounting

Vehicle finance

Inc. Vehicle sourcing

Development funding

Inc. Equity release

Supplier stories

Finance for suppliers

Get in touch

The Clear choice

And some FAQs

We know the business

We have a long history in it. We know the people and the language. We know the quirks and the pitfalls. That means you don’t need to.

Work with us and we’ll find you the best package with the best lender. A dedicated, sector specific project leader will be with you every step of the way. They’ll keep it pain free. We’ll make the process clear.

Strength in numbers

Our three founding directors were drawn together by a desire to better service the industry. Cut the complexities. Keep it simple.

Coming from different sectors (but all with ‘best rate’ reputations) it was clear they’d offer a bigger, better service together. That convergence of servicing has been the cornerstone of our success.

But why not go straight to the bank?

Banks have set rates and set solutions. That’s all they can sell you. With little sector specific knowledge they minimise their risk…with set charges.

We offer solutions from over 40 personally handpicked partners, both household names and niche players. Your solution will be clearly tailored.

Are quotes expensive?

No. They’re free and they take minutes. Our rates will likely beat the bank too because this is our market, we negotiate wholesale and pass on the benefits.

Is the process long?

Our partner relationships mean transactions are processed much quicker than if you were to apply directly. This cuts the wait from months to days.

Getting the right mix

Perfect partners

We’re a little like a financial dating agency. With our pool of over 40 hand-picked funding partners with their different knowledge bases and interests it is our job to match you with both the partner and the product that suit you best. So we’ll ask you plenty of questions. Because that’s the fast lane to financial prosperity.

It takes all sorts

You’ll see that some of our partners are massive household names while others are bigger in smaller pools. Real niche players. Rest assured we have a partner to suit you.

Customer stories

In businesses like yours

There are a number of sectors we’ve been active in. Some we’ve come to regard as specialities. You can group them by financial package also.

Select the images below to read more about how we support our clients.

- All

- Cashflow

- Commercial Loans

- Development

- Equipment

- Vehicle

Equipment finance

There are many types of finance available to companies. We’ll talk you through the options that suit you best. These two are the most common.

Hire Purchase

In a nutshell this is rent with the option to buy at the end. If something has a high residual value it can make sense to own it. It’s an asset. And you’ll benefit from your annual investment allowance.

Leasing

A little like renting. You pay to use something for a set period without the bind of ownership.

You get the benefit of upgrade options along the way and there are often tax advantages too.

We can also organise the sale and lease back / refinance of your equipment to free up funds. We can arrange an operating lease where you get to use the equipment leaving the lender to recover the residual value at the end. There’s a financial product to suit most needs.

Commercial loans

Multi purpose

Companies need loans for all sorts of purposes and in all sorts of circumstances. Corporation Tax, VAT, Working Capital, Capital Equipment, Property Development, Partner Buyouts and many more.

We can arrange unsecured loans with only a personal guarantee or secured loans against a property or asset. Total commercial sense.

Cash flow facilities

Trade finance

An increasingly popular product used to finance your supplies. We can organise funds for goods, services or staff. You’ll remain a cash buyer.

You can take on bigger jobs, bridge income gaps, negotiate harder and make multiple purchases.

All with a typical credit limit starting at £50,000 and a funding period from 30 – 180 days. And there’s no arrangement fee.

Invoice discounting

90% of any invoice value paid within 24 hours from a fully undisclosed facility allowing your finance team to stay on top.

Spot invoicing against individual invoices can also be arranged with no long-term financial commitment.

Vehicle finance

Keeping mobile

Company directors, partners and sole traders can benefit from finance as low as 3%. You pick the car, we’ll organise the finance on lease or HP or Contract Hire. In fact we can find the car for you too. Organise fleet vehicles, company vehicles or luxury cars on flexible terms from 1 to 5 years.

No-to-low deposit. New or used. Flexipayments. Flexiterms. Option to own with balloons up to 50%. A variety of contracts with different benefits to suit. Underwritten personally or by business.

Development funding

Property investment

We can reach agreement for up to 75% of gross development value or 80% of your acquisition costs in as little as 24 hours if you fall into any of these categories.

Property developers. Business expansions. New builds. Landlords. Buy to Lets.

If you already own a building and are in need of finance we can now also arrange Commercial Equity Release.

Bridging loans

If you find yourself in need of short-term funds and the bank just can’t move quick enough this could be the ideal solution. Bridge the gap before the long term funding kicks in. As much as £10 million from a few days to 6 months.

Supplier stories

In businesses like yours

There are a number of sectors we’ve been active in. Some we’ve come to regard as specialities. You can group them by financial package also.

Select the images below to read more about how we support our clients.

- All

- Hard Assets

- Manufacturer Schemes

- Soft Assets

Sales conversion

Keeping the door open

Not every client walks through the door cash rich. But you can still make the sale. The option of finance can deliver and still keep it quick and simple. Well we can offer you all of that.

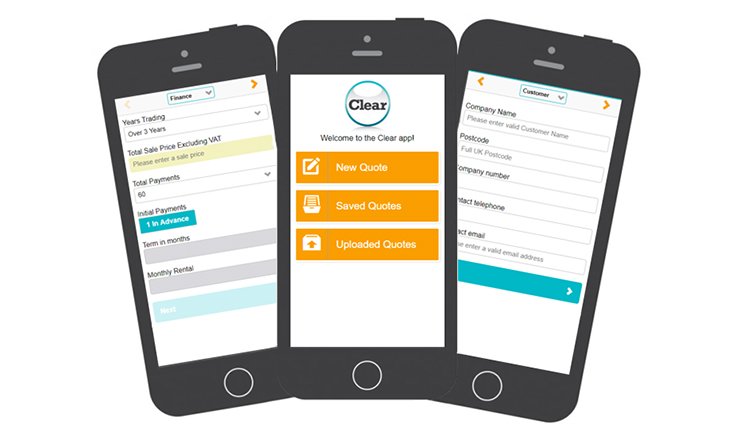

Keeping it simple

We’ve put together a set of custom digital tools using easy input, editing, submission, tracking and universal documentation (no need for separate forms or separate signatures to each potential funder) so you get instant quotes from our portal straight to your smartphone, iPad or desktop device.

Keeping it handy

Our App, which is tailored for every individual customer, means you can find the right funder with the right funds while you are still with the client. Accurate quotes with payment breakdowns delivered while they wait. You can strike while the iron’s hot.

See it in action for yourself at clearaf/partnersportal

Sealing the deal

For deals between £1000 & £200,000 we have our own dedicated esign system. It has a number of mutual benefits. Signing can be achieved from anywhere in the world (not withstanding WiFi). It’s paperless, making it greener, and most importantly you receive full payment upon delivery and the customer gets their new equipment so much faster.

Keeping thoroughly trained

Finance sales programme

The Clear Finance offering comes with a free one-day, face-to-face workshop tailored to your company requirements. Your place or ours. Capitalise sales through finance. We’ll take your team through the A–Z. Guaranteed ROI in weeks.

We’ll help rethink the value of your product while we cover the following checklist:

- Effective cost justification

- Competitive advantage

- Price challenge preparation

- Up-weighting order value

- Service & consumable sales

- Seize every deal

- Driving the decision

- Up-selling through finance

Get in touch

Call us today on 01277 239 943 or fill in the form below and we’ll get in touch with you.

Error: Contact form not found.

Clear Asset Finance Limited is registered in England, company number 07462914. Authorised and regulated by the Financial Conduct Authority under registration number 668175.